Foreclosure Update

by Osman Parvez

—-

Unsurprisingly, Boulder County had the lowest foreclosure rate of any metro county with 1 in 144 occupied units in foreclosure. However, according to the new report, foreclosures in 2006 in Colorado were up 31% from 2005 (as compared to 85% according to Realtytrac). That’s a huge difference.

Here’s a link to summary and methodology of the new report and the data. Here’s the press release.

(3/7/2006)

New 2006 Colorado Foreclosure Report

From 2005 through 2006 in Colorado, foreclosures increased 31% from 21,782 to 28,435. Between 2003 and 2006, foreclosures increased 110% from 13,575.

The study indicates that high foreclosure rates are primarily a phenomenon of the Front Range and the Eastern Plains. Foreclosure rates remain relatively low in the central mountains and on the Western Slope.

The counties with the most foreclosure filings per household were Adams, Weld, Arapahoe, Denver, and Pueblo. Adams and Weld counties topped the list with 1 in 32 and 1 in 37 households in foreclosure respectively. In Denver County, 1 in 47 households are in foreclosure. In the mountains and the Western Slope, foreclosure rates are much lower with Mesa County and Summit County reporting a foreclosure rate of 1 in 167 and 1 in 131 respectively. La Plata County reported a foreclosure rate of 1 in 382.

In the Denver Metro area, foreclosure rates ranged from 1 in 32 in Adams County to 1 in 144 in Boulder County. Boulder County reported fewer foreclosures her household than any other metro county. For example, Arapahoe County reported 1 in 43 and Douglas County reported 1 in 70. Statewide, there were approximately 1 in 58 households in foreclosure compared to 1 in 75 in 2005.

Throughout the Front Range, the foreclosure rate per household has worsened since 2003, the first year statewide Public Trustee data is available. The Public Trustee data contrasts with some earlier information released by other organizations that track foreclosures.

For example, Realtytrac has provided widely reported foreclosure data stating that in 2006, Colorado experienced 54,747 foreclosures, an 85% increase and had a total foreclosure rate of 1 in 33 households. In contrast, the new report indicates that Colorado has experienced an increase of 31% in foreclosures since 2005 and that only the most impacted counties have foreclosure rates near 1 in 33 while the statewide rate is 1 in 58.

This disparity is likely a function of different methods used in counting foreclosures. The Division of Housing assumes good faith on the part of Realtytrac, although it has concluded that the Realtytrac method overcounts foreclosures in Colorado.

The Colorado Division of Housing plans to continue counting foreclosure data from Public Trustees on a quarterly basis, and will be releasing data for the First Quarter of 2007 later this year.

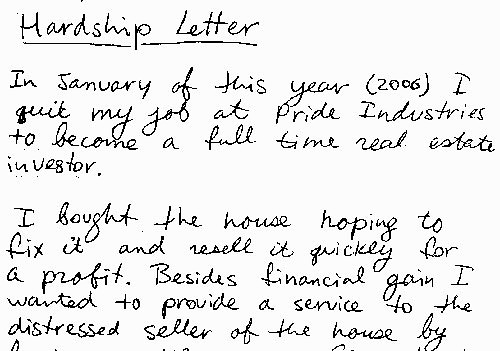

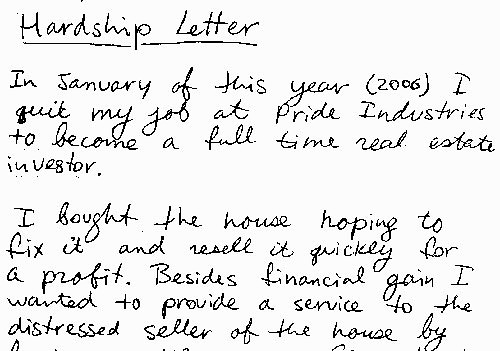

Image: Casey Serin

—-

Want to get blog updates via email? Click HERE.

Ready to buy or sell? Schedule an appointment or call 303.746.6896.

You can also like our Facebook page or follow us on Twitter.

As always, your referrals are deeply appreciated.

—

The ideas and strategies described in this blog are the opinion of the writer and subject to business, economic, and competitive uncertainties. We strongly recommend conducting rigorous due diligence and obtaining professional advice before buying or selling real estate.

Foreclosure Update

by Osman Parvez

—-

Unsurprisingly, Boulder County had the lowest foreclosure rate of any metro county with 1 in 144 occupied units in foreclosure. However, according to the new report, foreclosures in 2006 in Colorado were up 31% from 2005 (as compared to 85% according to Realtytrac). That’s a huge difference.

Here’s a link to summary and methodology of the new report and the data. Here’s the press release.

(3/7/2006)

New 2006 Colorado Foreclosure Report

From 2005 through 2006 in Colorado, foreclosures increased 31% from 21,782 to 28,435. Between 2003 and 2006, foreclosures increased 110% from 13,575.

The study indicates that high foreclosure rates are primarily a phenomenon of the Front Range and the Eastern Plains. Foreclosure rates remain relatively low in the central mountains and on the Western Slope.

The counties with the most foreclosure filings per household were Adams, Weld, Arapahoe, Denver, and Pueblo. Adams and Weld counties topped the list with 1 in 32 and 1 in 37 households in foreclosure respectively. In Denver County, 1 in 47 households are in foreclosure. In the mountains and the Western Slope, foreclosure rates are much lower with Mesa County and Summit County reporting a foreclosure rate of 1 in 167 and 1 in 131 respectively. La Plata County reported a foreclosure rate of 1 in 382.

In the Denver Metro area, foreclosure rates ranged from 1 in 32 in Adams County to 1 in 144 in Boulder County. Boulder County reported fewer foreclosures her household than any other metro county. For example, Arapahoe County reported 1 in 43 and Douglas County reported 1 in 70. Statewide, there were approximately 1 in 58 households in foreclosure compared to 1 in 75 in 2005.

Throughout the Front Range, the foreclosure rate per household has worsened since 2003, the first year statewide Public Trustee data is available. The Public Trustee data contrasts with some earlier information released by other organizations that track foreclosures.

For example, Realtytrac has provided widely reported foreclosure data stating that in 2006, Colorado experienced 54,747 foreclosures, an 85% increase and had a total foreclosure rate of 1 in 33 households. In contrast, the new report indicates that Colorado has experienced an increase of 31% in foreclosures since 2005 and that only the most impacted counties have foreclosure rates near 1 in 33 while the statewide rate is 1 in 58.

This disparity is likely a function of different methods used in counting foreclosures. The Division of Housing assumes good faith on the part of Realtytrac, although it has concluded that the Realtytrac method overcounts foreclosures in Colorado.

The Colorado Division of Housing plans to continue counting foreclosure data from Public Trustees on a quarterly basis, and will be releasing data for the First Quarter of 2007 later this year.

Image: Casey Serin

—-

Want to get blog updates via email? Click HERE.

Ready to buy or sell? Schedule an appointment or call 303.746.6896.

You can also like our Facebook page or follow us on Twitter.

As always, your referrals are deeply appreciated.

—

The ideas and strategies described in this blog are the opinion of the writer and subject to business, economic, and competitive uncertainties. We strongly recommend conducting rigorous due diligence and obtaining professional advice before buying or selling real estate.

Share This Listing!

More about the author

Osman Parvez

Owner & Broker at House Einstein as well as primary author of the House Einstein blog with over 1,200 published articles about Boulder real estate. His work has appeared in the Wall Street Journal and Daily Camera.

Osman is the primary author of the House Einstein blog with over 1,200 published articles about Boulder real estate. His work has also appeared in many other blogs about Boulder as well as mainstream newspapers, including the Wall Street Journal and Daily Camera. Learn more about Osman.

Work with

House Einstein

Thinking about buying or selling and want professional advice?

Call us at 303.746.6896

Your referrals are deeply appreciated.