SuperStar Cities: The Benefits of Talent and Capital

by Osman Parvez

—-

Why do some cities have higher real estate values than others? According to one study, it’s driven by (a) the scarcity of housing units, (b) the growing number of high income families in the United States, and (c) the fact that high-income families have been willing to outbid lower-income families for scarce housing in preferred locations.

But it turns out there’s more to the story. It’s also about the increasing mobility of Americans, creativity, capital, and expected migration trends in the future. Wealth and creativity have clustered in the United States and the clustering is one of the most overlooked factors in understanding real estate trends. When Richard Florida first wrote about The Rise of the Creative Class he probably didn’t realize how significant this impact would become.

In Where the Brains Are, Florida writes,

What’s behind this phenomenon? Some of the reasons for it are essentially aesthetic—many of the means metros are beautiful, energizing, and fun to live in. But there is another reason, rooted in economics: increasingly, the most talented and ambitious people need to live in a means metro in order to realize their full economic value.

The physical proximity of talented, highly educated people has a powerful effect on innovation and economic growth—in fact, the Nobel Prize–winning economist Robert Lucas declared the multiplier effects that stem from talent clustering to be the primary determinant of growth. That’s all the more true in a postindustrial economy dependent on creativity, intellectual property, and high-tech innovation.

So why do people come here? They come for the sunshine. They come for the outdoor recreation. They come for the quality of life. And they come for jobs that help them reach their fullest potential. Many end up creating jobs. As these factors multiply, there’s potential for it to build on itself, allowing our region to enjoy continued economic prosperity. If the authors of the studies and articles mentioned above are right, the future is bright indeed.

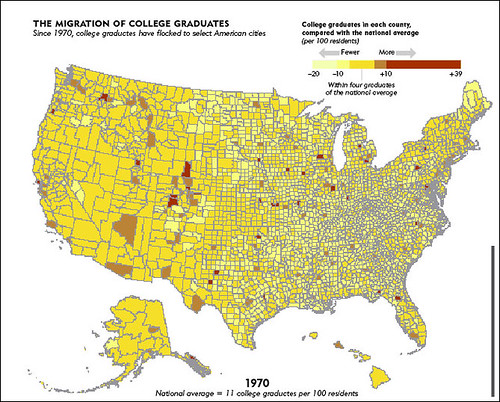

The charts below show the distribution of college graduates in 1970 and 2000. 30 years ago, college grads were much more evenly distributed. Today, they’re clustered in select areas. Look closely. Our region is among the most dense in college graduates.

credits: Richard Florida, Joseph Gyourko, Christopher Mayer, and Todd Sinai.

hat tip: R.Carson

image: Dawn Endico

—-

Want to get blog updates via email? Click HERE.

Ready to buy or sell? Schedule an appointment or call 303.746.6896.

You can also like our Facebook page or follow us on Twitter.

As always, your referrals are deeply appreciated.

—

The ideas and strategies described in this blog are the opinion of the writer and subject to business, economic, and competitive uncertainties. We strongly recommend conducting rigorous due diligence and obtaining professional advice before buying or selling real estate.

SuperStar Cities: The Benefits of Talent and Capital

by Osman Parvez

—-

Why do some cities have higher real estate values than others? According to one study, it’s driven by (a) the scarcity of housing units, (b) the growing number of high income families in the United States, and (c) the fact that high-income families have been willing to outbid lower-income families for scarce housing in preferred locations.

But it turns out there’s more to the story. It’s also about the increasing mobility of Americans, creativity, capital, and expected migration trends in the future. Wealth and creativity have clustered in the United States and the clustering is one of the most overlooked factors in understanding real estate trends. When Richard Florida first wrote about The Rise of the Creative Class he probably didn’t realize how significant this impact would become.

In Where the Brains Are, Florida writes,

What’s behind this phenomenon? Some of the reasons for it are essentially aesthetic—many of the means metros are beautiful, energizing, and fun to live in. But there is another reason, rooted in economics: increasingly, the most talented and ambitious people need to live in a means metro in order to realize their full economic value.

The physical proximity of talented, highly educated people has a powerful effect on innovation and economic growth—in fact, the Nobel Prize–winning economist Robert Lucas declared the multiplier effects that stem from talent clustering to be the primary determinant of growth. That’s all the more true in a postindustrial economy dependent on creativity, intellectual property, and high-tech innovation.

So why do people come here? They come for the sunshine. They come for the outdoor recreation. They come for the quality of life. And they come for jobs that help them reach their fullest potential. Many end up creating jobs. As these factors multiply, there’s potential for it to build on itself, allowing our region to enjoy continued economic prosperity. If the authors of the studies and articles mentioned above are right, the future is bright indeed.

The charts below show the distribution of college graduates in 1970 and 2000. 30 years ago, college grads were much more evenly distributed. Today, they’re clustered in select areas. Look closely. Our region is among the most dense in college graduates.

credits: Richard Florida, Joseph Gyourko, Christopher Mayer, and Todd Sinai.

hat tip: R.Carson

image: Dawn Endico

—-

Want to get blog updates via email? Click HERE.

Ready to buy or sell? Schedule an appointment or call 303.746.6896.

You can also like our Facebook page or follow us on Twitter.

As always, your referrals are deeply appreciated.

—

The ideas and strategies described in this blog are the opinion of the writer and subject to business, economic, and competitive uncertainties. We strongly recommend conducting rigorous due diligence and obtaining professional advice before buying or selling real estate.

Share This Listing!

More about the author

Osman Parvez

Owner & Broker at House Einstein as well as primary author of the House Einstein blog with over 1,200 published articles about Boulder real estate. His work has appeared in the Wall Street Journal and Daily Camera.

Osman is the primary author of the House Einstein blog with over 1,200 published articles about Boulder real estate. His work has also appeared in many other blogs about Boulder as well as mainstream newspapers, including the Wall Street Journal and Daily Camera. Learn more about Osman.

Work with

House Einstein

Thinking about buying or selling and want professional advice?

Call us at 303.746.6896

Your referrals are deeply appreciated.