Business Update 3/12

by Osman Parvez

—-

|

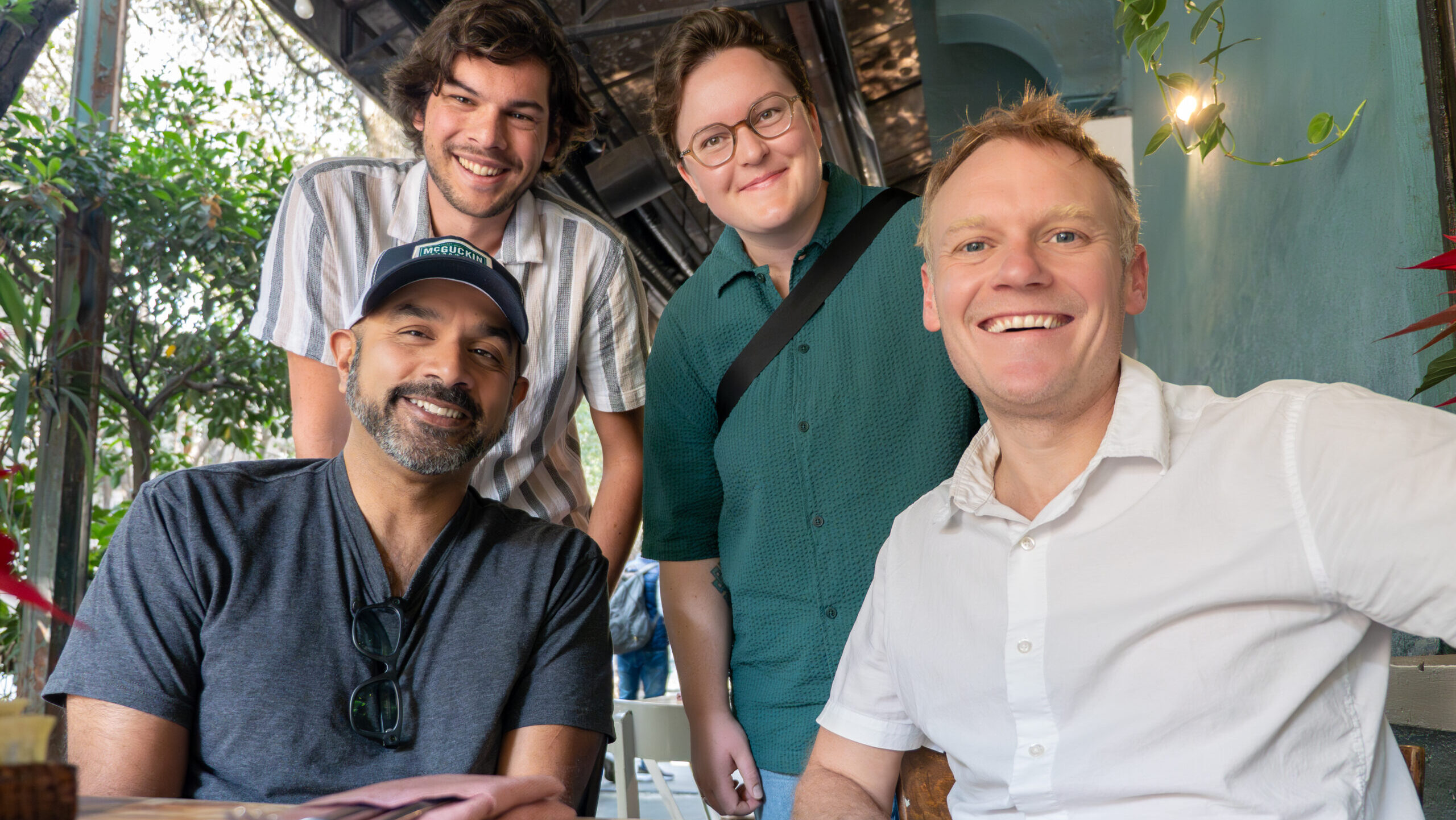

First, a shout-out to the staff at the Southern Sun. As regulars know, it’s hard to get a table at this very popular South Boulder restaurant. Last night, they handled a gathering of 20 for my fiancé’s birthday party. They crushed it. Many of our clients turn into friends. A number joined us last night. p.s. Tyler, I totally spaced inviting you. Let’s make up a date.

Our new blog is launched. It looks amazing and we love it. Unfortunately, the template also grabs the first photo which means the older content now shows a giant, pixelated profile photo of our faces. We’re going to go through 2018 content to move photos around (our faces will now appear more often at the bottom of posts).

We’re getting quite a few relocation clients. They’re coming from the Bay Area, New York, Boston, and Europe. This is not new, but appears to be accelerating. I would say we’re into our third wave of Google employees, and other tech workers/investors. They’ve ranged from mid-level employees to higher level executives/investors. Our systems for relocation buyers are fairly well developed and proven successful, but we’ve learned they have to be discussed on a case-by-case basis. Some buyers are already here and renting. Others are planning to move here in several years and want to deploy capital now, before prices rise higher. How much prices may continue to go up is another topic entirely, but it’s worthwhile to note the anecdotal motivations.

Among a lot of other Boulder real estate, I took a buyer to see the new units at the Peloton. I’ve also begun the process of updating my analysis. I’ve tracked this development since it broke ground in 2007. I’ve also sold several units (representing both buyers and sellers). Because of the amenities, design, and location – the Peloton remains a popular choice and the top of the list for this buyer. Like all real estate, buyers need to fully evaluate their investment. At this time, I recommend potential buyers consider the impact of the Fruehauf development, ongoing litigation with the developer over defects, and current limited liquidity due to portfolio-loan only financing. You should also compare to new build units at S’park and the cost to rehab a unit at Horizons West. While we were there, we also saw a resale unit and the listing agent was present, which made for an awkward showing. As a buyer’s agent, it’s difficult to assess and discuss a property honestly with your client, when the listing agent wants to debate the pros/cons. Agents – if you agreed to be present at all showings, the best move is to wait outside while the showing is conducted and answer questions when we exit.

I fired a client. This is a rare event. Most of our buyers and sellers are spectacular people who deeply appreciate our efforts. In this case, our client was repeatedly dishonest about their situation and motivations. We had already invested a lot of resources on their behalf, but it simply had to be treated as a sunk cost. We conduct our business with integrity and authenticity, with transparency and honesty. We respect our clients and our colleagues. Trust isn’t automatic, it’s earned and without trust, every aspect of a deal becomes difficult. By letting go of a bad relationship, we have more resources to offer our positive and healthy relationships. We can work harder, perform better, and be more satisfied with the experience. We wish that former client well in their real estate endeavors.

|

| Warped wood paneling and no flooring = flood damage |

We evaluated a ranch property in South Boulder that at first glance, was underpriced by about $200K. The asking price was $435K (the reverse mortgage balance). It was also (mis) marketed only on the Denver MLS and due to high interest, available for less than 48 hours before the door slammed shut. I was initially excited about it. Real estate market inefficiencies are often opportunities, but after visiting the property, it became clear that it wasn’t a great investment. Here’s the back of the envelope: The going rate for a similar property in a better location starts about $630K. Subtract 15% for the busy location, contract requirement for cash offers only, no contingencies, and a lot of unknown risk. Now, you’re at $536K. The house itself was in rough condition. At a minimum, it needed egress windows, a completely new basement finish, refinished bathrooms and kitchens. The only saving grace were the water heater and furnace looked good. It also appeared to have a newer electrical panel. The roof was probably OK. The sewer line and other plumbing was probably not, given its material and age (60 year old cast iron main to clay pipe). After closing, I estimated a minimum $100K in follow on capital to remove the junk, fully rehab the house as a five bedroom (with a permit), and make it comply with Boulder’s Smart Regs. So if you could buy it for $436K, or less there was an opportunity. Even so, it will still make a poor flip due to the busy location. Bottom line: As an investment, this only made sense as a fix and rent for cash flow play. The right buyer is one who probably owns a construction company and can control their costs. In this market, it’s difficult to find contractors and labor costs are very high. It’s now under contract. p.s. There’s a lot of sadness with estate sales, especially when there are signs of financial and psychological distress. I’m renewing my commitment to be a minimalist.

|

| Monte Carlo Simulation, Not Needed |

We were invited by a buyer to take a closer look at the house on Linden Park that we blogged about two weeks ago. As expected, the key to valuation is the ownership of the adjacent half lot. How do you value an option that has an uncertain opportunity to ever be exercised? It also costs a significant amount annually in taxes to keep the option. Meanwhile, it’s a fresh listing and the seller wants to value it as a buildable lot. We didn’t see it that way. Bottom line: Cool house, but at price approaching $2MM, the half lot situation needed to be resolved for my client. We passed.

The farm deal is slowly moving ahead. The gating factors are to determine the type of farm loan and to make sue the economics work for the investor. It looks like an 8% annual return might be possible, but not without equivalent risk. This is ripe for an investor that wants to get involved with local sustainable agriculture and put their eco-values to work. As I’ve stated previously, this isn’t a particularly large purchase, but we’re motivated to work on it because it supports our values. I may end up putting some capital on the investor side, personally. If you’re an ag lender reading this, or an individual investor looking for a sustainable farm play, call me.

We’re considering acquiring art instead of featuring rotating art for our office. The time to line up artists is significant. We’re also not a coffee shop, which means we don’t have high foot traffic in our office. Art sale potential is low. For an artist, it’s best to think of this as gallery space to host a reception and then feature your art for 1-2 months without any fees. Because we’re in the Nobo Art District, we hope we’ll attract more artists but the jury is still out.

—-

Ready to buy or sell? Schedule an appointment or call 303.746.6896.

You can also like our Facebook page or follow us on Twitter.

As always, your referrals are deeply appreciated.

—

The ideas and strategies described in this blog are the opinion of the writer and subject to business, economic, and competitive uncertainties. We strongly recommend conducting rigorous due diligence and obtaining professional advice before buying or selling real estate. Image: Chris Liverani

Business Update 3/12

by Osman Parvez

—-

|

First, a shout-out to the staff at the Southern Sun. As regulars know, it’s hard to get a table at this very popular South Boulder restaurant. Last night, they handled a gathering of 20 for my fiancé’s birthday party. They crushed it. Many of our clients turn into friends. A number joined us last night. p.s. Tyler, I totally spaced inviting you. Let’s make up a date.

Our new blog is launched. It looks amazing and we love it. Unfortunately, the template also grabs the first photo which means the older content now shows a giant, pixelated profile photo of our faces. We’re going to go through 2018 content to move photos around (our faces will now appear more often at the bottom of posts).

We’re getting quite a few relocation clients. They’re coming from the Bay Area, New York, Boston, and Europe. This is not new, but appears to be accelerating. I would say we’re into our third wave of Google employees, and other tech workers/investors. They’ve ranged from mid-level employees to higher level executives/investors. Our systems for relocation buyers are fairly well developed and proven successful, but we’ve learned they have to be discussed on a case-by-case basis. Some buyers are already here and renting. Others are planning to move here in several years and want to deploy capital now, before prices rise higher. How much prices may continue to go up is another topic entirely, but it’s worthwhile to note the anecdotal motivations.

Among a lot of other Boulder real estate, I took a buyer to see the new units at the Peloton. I’ve also begun the process of updating my analysis. I’ve tracked this development since it broke ground in 2007. I’ve also sold several units (representing both buyers and sellers). Because of the amenities, design, and location – the Peloton remains a popular choice and the top of the list for this buyer. Like all real estate, buyers need to fully evaluate their investment. At this time, I recommend potential buyers consider the impact of the Fruehauf development, ongoing litigation with the developer over defects, and current limited liquidity due to portfolio-loan only financing. You should also compare to new build units at S’park and the cost to rehab a unit at Horizons West. While we were there, we also saw a resale unit and the listing agent was present, which made for an awkward showing. As a buyer’s agent, it’s difficult to assess and discuss a property honestly with your client, when the listing agent wants to debate the pros/cons. Agents – if you agreed to be present at all showings, the best move is to wait outside while the showing is conducted and answer questions when we exit.

I fired a client. This is a rare event. Most of our buyers and sellers are spectacular people who deeply appreciate our efforts. In this case, our client was repeatedly dishonest about their situation and motivations. We had already invested a lot of resources on their behalf, but it simply had to be treated as a sunk cost. We conduct our business with integrity and authenticity, with transparency and honesty. We respect our clients and our colleagues. Trust isn’t automatic, it’s earned and without trust, every aspect of a deal becomes difficult. By letting go of a bad relationship, we have more resources to offer our positive and healthy relationships. We can work harder, perform better, and be more satisfied with the experience. We wish that former client well in their real estate endeavors.

|

| Warped wood paneling and no flooring = flood damage |

We evaluated a ranch property in South Boulder that at first glance, was underpriced by about $200K. The asking price was $435K (the reverse mortgage balance). It was also (mis) marketed only on the Denver MLS and due to high interest, available for less than 48 hours before the door slammed shut. I was initially excited about it. Real estate market inefficiencies are often opportunities, but after visiting the property, it became clear that it wasn’t a great investment. Here’s the back of the envelope: The going rate for a similar property in a better location starts about $630K. Subtract 15% for the busy location, contract requirement for cash offers only, no contingencies, and a lot of unknown risk. Now, you’re at $536K. The house itself was in rough condition. At a minimum, it needed egress windows, a completely new basement finish, refinished bathrooms and kitchens. The only saving grace were the water heater and furnace looked good. It also appeared to have a newer electrical panel. The roof was probably OK. The sewer line and other plumbing was probably not, given its material and age (60 year old cast iron main to clay pipe). After closing, I estimated a minimum $100K in follow on capital to remove the junk, fully rehab the house as a five bedroom (with a permit), and make it comply with Boulder’s Smart Regs. So if you could buy it for $436K, or less there was an opportunity. Even so, it will still make a poor flip due to the busy location. Bottom line: As an investment, this only made sense as a fix and rent for cash flow play. The right buyer is one who probably owns a construction company and can control their costs. In this market, it’s difficult to find contractors and labor costs are very high. It’s now under contract. p.s. There’s a lot of sadness with estate sales, especially when there are signs of financial and psychological distress. I’m renewing my commitment to be a minimalist.

|

| Monte Carlo Simulation, Not Needed |

We were invited by a buyer to take a closer look at the house on Linden Park that we blogged about two weeks ago. As expected, the key to valuation is the ownership of the adjacent half lot. How do you value an option that has an uncertain opportunity to ever be exercised? It also costs a significant amount annually in taxes to keep the option. Meanwhile, it’s a fresh listing and the seller wants to value it as a buildable lot. We didn’t see it that way. Bottom line: Cool house, but at price approaching $2MM, the half lot situation needed to be resolved for my client. We passed.

The farm deal is slowly moving ahead. The gating factors are to determine the type of farm loan and to make sue the economics work for the investor. It looks like an 8% annual return might be possible, but not without equivalent risk. This is ripe for an investor that wants to get involved with local sustainable agriculture and put their eco-values to work. As I’ve stated previously, this isn’t a particularly large purchase, but we’re motivated to work on it because it supports our values. I may end up putting some capital on the investor side, personally. If you’re an ag lender reading this, or an individual investor looking for a sustainable farm play, call me.

We’re considering acquiring art instead of featuring rotating art for our office. The time to line up artists is significant. We’re also not a coffee shop, which means we don’t have high foot traffic in our office. Art sale potential is low. For an artist, it’s best to think of this as gallery space to host a reception and then feature your art for 1-2 months without any fees. Because we’re in the Nobo Art District, we hope we’ll attract more artists but the jury is still out.

—-

Ready to buy or sell? Schedule an appointment or call 303.746.6896.

You can also like our Facebook page or follow us on Twitter.

As always, your referrals are deeply appreciated.

—

The ideas and strategies described in this blog are the opinion of the writer and subject to business, economic, and competitive uncertainties. We strongly recommend conducting rigorous due diligence and obtaining professional advice before buying or selling real estate. Image: Chris Liverani

Share This Listing!

More about the author

Osman Parvez

Owner & Broker at House Einstein as well as primary author of the House Einstein blog with over 1,200 published articles about Boulder real estate. His work has appeared in the Wall Street Journal and Daily Camera.

Osman is the primary author of the House Einstein blog with over 1,200 published articles about Boulder real estate. His work has also appeared in many other blogs about Boulder as well as mainstream newspapers, including the Wall Street Journal and Daily Camera. Learn more about Osman.

Work with

House Einstein

Thinking about buying or selling and want professional advice?

Call us at 303.746.6896

Your referrals are deeply appreciated.