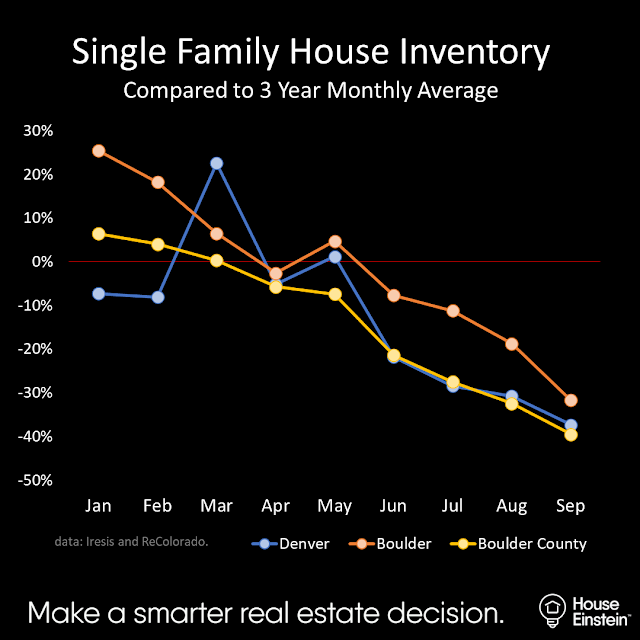

An important note about the information presented below. Some of the charts show monthly data expressed as a percentage from the average. So for example, when you see +27%, it means 27% above the average for that month. It does not mean 27% of the average. Capiche?

SUPPLY

When faced with uncertainty, people take fewer risks. It’s just human nature. Since Covid-19 hit, potential sellers of single family houses have bunkered down. Beginning this spring, inventory of homes available to purchase has fallen dramatically.

The latest data shows shows inventory in the City of Boulder is now 32% below the monthly average and down 40% in Boulder County. Inventory in Denver is down 37% and in Longmont, down 39%.

It’s not just a one month anomaly. It’s a trend.

The chart above shows inventory for the City of Denver, City of Boulder, and Boulder County for detached single family houses – expressed as a variance from the average of the past three years.

Both the City of Boulder and Boulder County started off the year with more than average inventory. Then Covid hit. When lockdowns were lifted in May, there was a short blip, but after that the inventory began plunging.

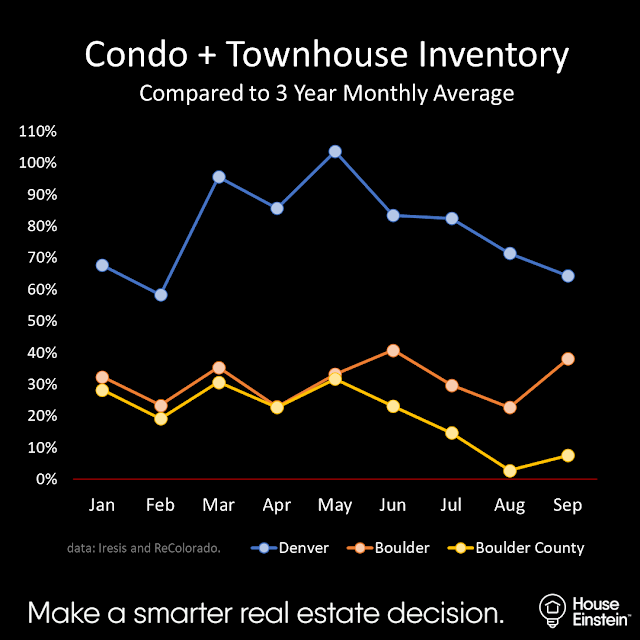

Meanwhile, it’s not the same story for townhomes and condos. Since the beginning of the year, inventory in the City of Boulder has bounced between 20% and 40% above average. The County started out much the same, but has seen a general reduction. It’s now very close to average.

In Denver, inventory started off the year very high, and then in response to Covid, spiked even higher. It has ranged from 64% to 104% above average since January.

In contrast to the shortage of houses, there’s plenty of townhomes and condos available for purchase, especially in the City of Denver. For buyers, this is good news. It means more selection than the past several years, but has that translated to lower prices? Keep reading, I’ll get to that in the moment .

Just remember: conditions vary by location and price range, down to the street level. Always consult with your real estate adviser before making a purchase or sale decision.

DEMAND

Now that we’ve looked at the supply side of the economic equation, let’s take a look at demand.

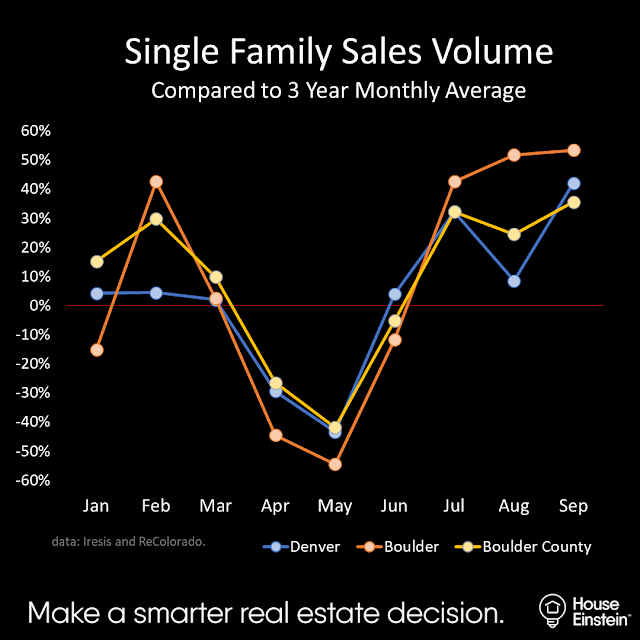

The chart above shows sales volume for single family (detached) houses. Although not a perfect measure of demand, it’s a good enough proxy.

Covid had a dramatic effect on sales in April and May, followed by a strong bounce in the third quarter. Although sellers stayed home after the lockdown (literally), buyers apparently did not.

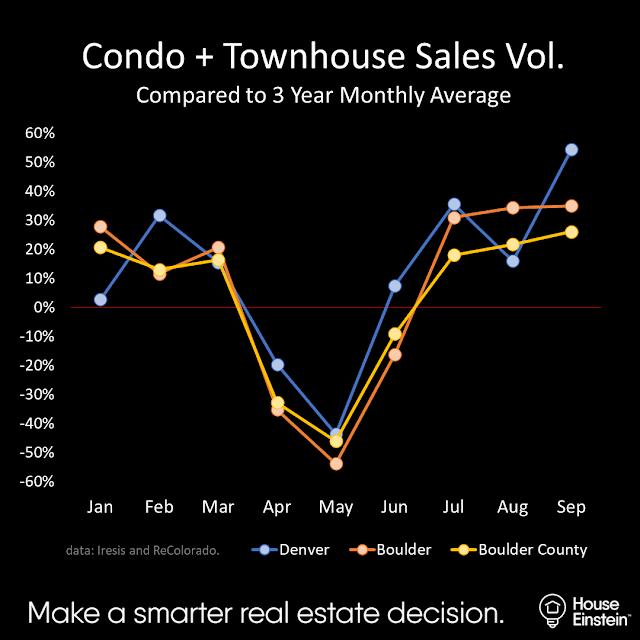

Here’s the same chart for condos and town houses, showing the same pattern: a dramatic pause in sales during the 2nd quarter, with a corresponding bounce in the 3rd quarter.

Q: Since the first lockdown, have sales recovered completely? The answer is a surprising yes.

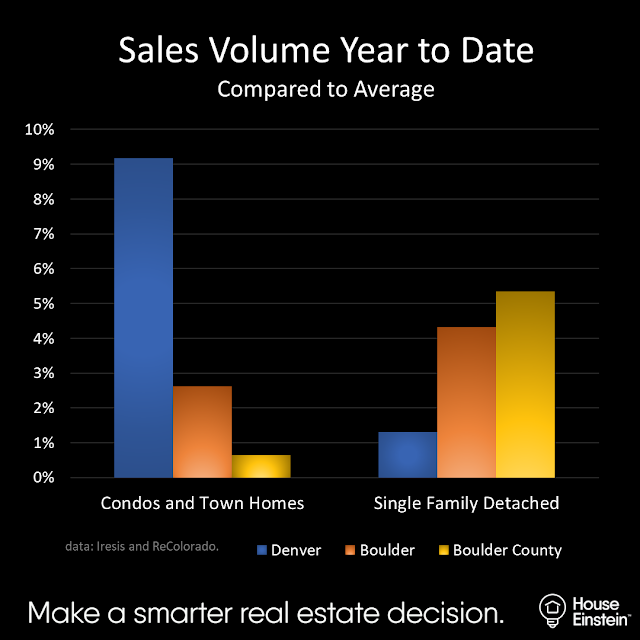

The chart above shows cumulative sales volume, year to date. The large inventory increase for condos in Denver appears to be having an effect. Greater selection for buyers coupled with ultra low mortgage rates has translated to much higher sales, up +9%. Sales are also up for Boulder and Boulder County, although not nearly as much.

The market has now recovered for single family houses as well, with Boulder County making a strong showing. Sales are up 5.3% YTD. Longmont (not shown in the chart) has been performing even better – sales are up 6.9% YTD.

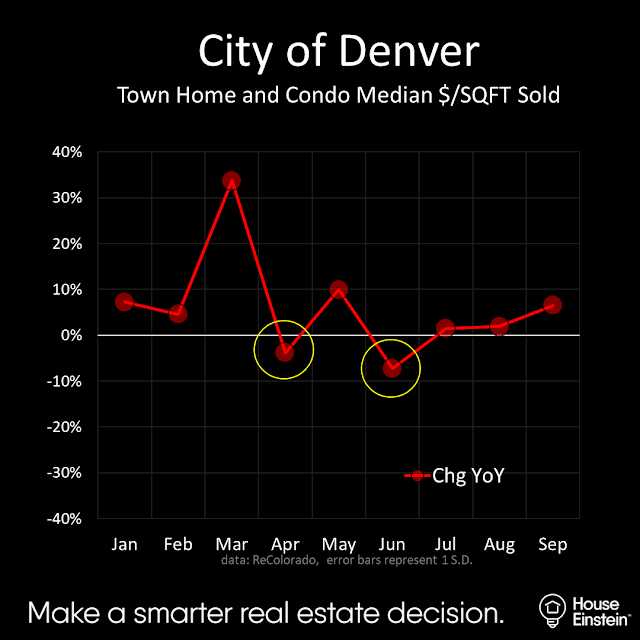

Q: Has the added supply put any downward pressure on prices? The surprising answer: not really.

The chart above shows median $/SQFT sold prices for Denver condos and townhomes, compared to the previous year. There have only been two months during the year when median prices were below the previous year (see more charts for Denver condo prices on our Facebook page).

CONCLUSIONS

We’re about to enter the slowest time of year for Boulder real estate. November and December tend to be a period of very little listings and unmotivated buyers. But the market wakes up on January 1.

Based on the past few months, the first quarter of 2021 should be an exceptional time to sell a house. With that said, if you don’t have an investment alternative in your pocket with better risk/return characteristics, we’ve been advising our clients to hold onto their real estate assets. Meanwhile, if you own a home that in normal markets might be difficult to unload – such as those in compromised locations or with serious deferred maintenance, now would be a very smart time to prepare for January.

For house buyers, inventory is in horrendous condition. We’ve been helping our clients navigate intense bidding wars, except at certain higher ends points of the price range. Again, the charts above tell the reason why. The real estate market is experiencing a serious inventory shortage and there’s no end in sight.

If you’re in the market to acquire a townhome or condo, inventory is actually pretty good. More supply means you have more options than you’ve had in years. To protect against short-term downside risk, we’ve been cautioning our clients to be highly selective in which properties are worthy of offers.

What Does the Future Hold?

First things first. Nobody has a crystal ball. In these uncertain times, this goes without saying. Still, we think it’s important to look at the trends, and track market activity, so we can better advise our buyers and sellers.

In theory, extreme deficit spending across the world to fund stimulus measures and keep global economies afloat should spill out in economically predictable ways (i.e. inflation). Interim volatility might carry opportunity or misfortune. What should a well informed real estate buyer or seller do?

The science strongly suggests Covid will be an 18-24 month event before normalcy returns. This means we are somewhere between 1/3 and 1/2 of the way through this pandemic. We’re also on the eve of a historic Presidential election, with a risk of violent reactions for either winner. This adds tremendous uncertainty.

Rather than focus on the extreme short-term, we prefer to focus on longer term, enduring trends – some of which appear to have temporarily reversed. For decades, young people have been flocking to dense, urban cities. The Covid driven exodus from these cities is likely short-term. Cities are where you’ll find the highest density of art, entertainment, economic opportunity, and cultural diversity. They’re vibrant places to live, in normal times. With many buyers myopically headed the other way, it might be time for a contrarian investment thesis; to zig while the market zags.

The Joe Rogan Effect

Study human behavior long enough, and you’ll discover a powerful phenomena: social proof.

Enter Joe Rogan.

As you’re probably aware, Joe Rogan has recently become one of the most popular celebrities on the planet, largely due to his long-form podcast and willingness to interview controversial people. Like him or not, he now has a massive, Oprah-sized platform.

What has he been talking about recently? Around the same time he secured a reported +$100MM contract with Spotify, he completed a well publicized move from California to Texas. Given the massive tax implications of his contract, it’s not exactly a surprise why he would choose to do so. Just in case you missed the memo, he’s been harping about it publicly: he moved due to excessive current and likely future state taxes and political mismanagement of California, resulting in out of control crime and homelessness. In other words, California is getting more expensive and quality of life is degrading. Joe’s decision will influence many others contemplating the same.

Certainly, YOU aren’t going to pack up and leave California solely because Joe Rogan did it. At least not consciously. However if you were already thinking about it, and your job goes into work from home mode, and your kids are learning from home too – do you think it might have an impact on your decision? You bet it will. Let’s call it the Joe Rogan effect.

All humans are intensely influenced by social proof. It’s hard-wired our biology. That’s why marketers pay celebrities and influencers to wear their products. High profile celebrities who publicly pack up and leave for greener pastures have a powerful subconscious influence on others to do the same.

Meanwhile, talent and capital have been increasingly mobile for decades, well before Covid. Work from home and school closings only grease the skids of this trend.

Where are people moving from and where are they going? They’re moving to places that offer high quality of life, economic opportunities, good weather, outdoor recreation, good public schools, low crime, and… yes, low taxes.

In the last nine years, Colorado has grown by 14% (according to the State Demographer). We’re growing by an average of ~79,000 people per year, or more than 200 people per day. We should continue to see increased migration, in both the short and long term. This means more buyers in the market, and until there is more economic certainty, likely even fewer homes available for sale.

What does this have to do with Boulder? Our community has long been recognized as one of the best places to live in the country and the list of awards keep growing. For many years, we’ve been coping with changing demographics, intense buyer demand, and little inventory. Home buyers want what Boulder has been selling. Don’t be fooled by short-term volatility. There’s no indication of a shift on the horizon.

Osman Parvez is the Founder and Employing Broker of House Einstein. Originally from the Finger Lakes region of New York, he lives in Boulder with his wife and their Labrador Retriever. He has been a Realtor since 2005.

Osman is the primary author of the House Einstein blog with over 1,200 published articles about Boulder real estate. His work has also appeared in many other blogs about Boulder as well as mainstream newspapers, including the Wall Street Journal and Daily Camera. For more information, click HERE.

Fresh Listings | Our review of the most compelling new listings to hit the Boulder real estate market.| Subscribe

Thinking about buying or selling and want professional advice? Call us at 303.746.6896. Your referrals are deeply appreciated.

The ideas and strategies described in this blog are the opinion of the writer and subject to business, economic, and competitive uncertainties. House Einstein strongly recommends conducting rigorous due diligence and obtaining professional advice before buying or selling real estate.